How Much Does Capital Equipment Actually Cost?

/ Blog

Consider the Hidden Costs

If you’re in the market to purchase capital equipment for your mill, you’ve probably been advised to consider the “hidden costs” associated with such a purchase. Hidden costs refer to the expenses of a purchase that aren’t clearly defined on a price tag or quote.

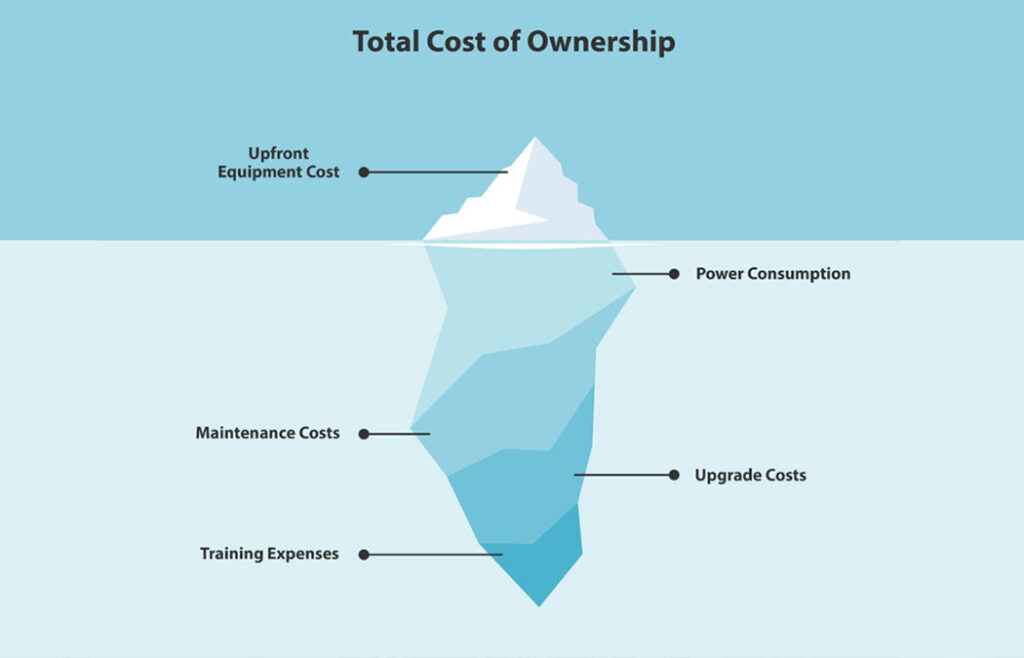

A common metaphor for hidden costs is an iceberg in the ocean. From what you can see of the iceberg above the water, you may assume that it is relatively small. However, the vast majority of an iceberg’s mass lies beneath the waterline—you’re only looking at the tip of the iceberg.

The same principle applies to the cost of capital equipment—the ticket price sits above the surface in plain sight while the largest expenses, such as power consumption and maintenance costs, require experience, interpretation and proper predictive modeling to figure out.

Determine the Total Cost of Ownership

For this reason, I prefer to use the phrase total cost of ownership (TCO) instead of “hidden costs,” because there is nothing “hidden” about the costs associated with manufacturing—in fact, I would say most people are keenly aware of them , they simply do not factor them into the purchasing process. We have the knowledge to make the right choice, but we are not encouraged to evaluate the long-term ownership picture.

If a quote for capital equipment was wholistic, line items in the quote would include:

Total Cost of Ownership:

- Power Consumption

- Maintenance Costs (Parts + Service Hours + Lost Production Hours)

- Upgrade Costs (Required Upgrades for the Upgrades + Falling Behind on Innovation)

- Training Expenses (Teaching outdated systems + lost worker efficiency)

If manufacturers did add these to quotes, the low quote price paired with their monumental TCO would deter anyone from buying. Unfortunately, sometimes the smaller the quote, the larger the TCO.

DC Cranes versus AC Cranes

A great example of total cost of ownership that I’ve encountered is the difference in TCO between replacing an old DC crane with a new DC crane versus upgrading to an AC crane. Our customer at Cleveland-Cliffs Burns Harbor discovered that when they considered the cost of a crane over its entire lifetime, the option with the larger upfront cost was actually the most cost effective (view case study here).

As you’re comparing quote prices between different capital equipment manufacturers, remember that sometimes the quote with the higher number can often be the frugal choice.

At Morgan, we help our customers evaluate the total cost of ownership by diving deeper into our customers’ operations to understand energy consumption and current maintenance costs, factoring those considerations into our proposals, and walking our customers through the decision-making process to help them choose the options that will deliver the most long-term value.